DeLoreans are rare, especially ones with the flux capacitor option. But if we happened on a pristine example, set the date to 2044 and mashed the pedal, what would we see upon our arrival? Would the energy landscape resemble an ocean where energy consumers and producers are in constant contact, fluidly exchanging energy to capitalize on small differences in price, or would it resemble an archipelago where everyone produces their own energy locally like an island? And what’s so special about 2044?

Well, it has been 30 years since the consent decree broke up the Bell Operating Companies that had previously provided local telephone service over copper land-lines in the United States. At the end of 2012, fully half of American households had no land-line telephone service whatsoever, relying 100% on wireless carriers for their real time interpersonal communications. That is a remarkable transformation by any measure, and verifies 30 years as plenty of time for a sweeping sea change. Plus, 30 years is well within the capability of a standard DeLorean flux capacitor.

So ocean or archipelago; the answer may be tied up in how social obligation colors this 30-year sea change. Before diving into the how and the why, though, it’s worth spending a few words on the what.

Ocean

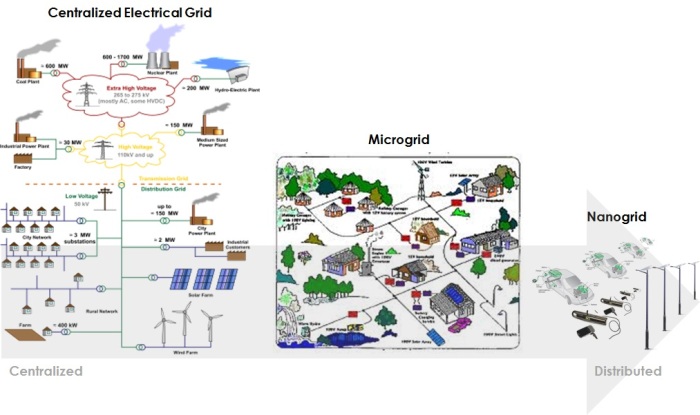

What is an energy ocean? Arriving at an energy ocean requires dramatic change to be sure, but most of the fundamental pieces of today’s energy ecosystem remain. Transmission exists. Its role involves bi-directional interstate energy delivery with service offerings delineated by capacity and quality. A consumer of transmission services buys, say, two terawatts of peak transmission capacity per month with five “9”s of reliability at a much higher price than if they were buying 150 gigawatts of off-peak transmission capacity at three “9”s of reliability. This consumer of transmission capacity may be pulling or pushing energy through this transmission pipe.

Distribution exists as well, with a similar role in the energy ecosystem as transmission but covering smaller capacities and more regional geographies; megawatt and kilowatt capacities spanning cities and neighborhoods with similar service level agreements for reliability.

Centralized generation continues to participate in the ecosystem, utilizing transmission and distribution to deliver product into markets that lack the resources for distributed generation. Yet centralized generation lives right alongside distributed generation, competing for customers on price and quality, each winning business when and where its service and economics are more favorable.

Finally, energy consumers remain in the ecosystem, but their energy bills are decoupled. Line items appear for the kilowatt-hours of off-site energy consumed but also for the distribution and/or transmission infrastructure used along the way for delivery to the service address when consuming as well as when generating and delivering energy offsite, beyond the meter. What’s more, a single service address may have multiple meters provided by different energy companies measuring different businesses in which a single service address is participating. Even more fundamentally, however, all these ecosystem pieces are connected. The grid remains.

Archipelago

On the other hand, what is an energy archipelago? An energy archipelago looks very different from an energy ocean, even though both involve water. Connectedness is gone. Each service address is an island that generates all of its energy needs locally. No transmission or distribution or centralized generation exists and in fact, the grid is no more.

In some regions where there is a dearth of locally available fuels like sunshine, wind or geothermal, there will be alternative fuels. Natural gas and hydrogen delivered via pipeline and used in high-efficiency fuel cells are examples; other examples will emerge to fill this gap as well.

The consumer’s conception of energy changes radically as well. Instead of an ongoing energy service measured in kilowatt-hours, energy morphs into just another appliance like a refrigerator or a furnace. It’s an expensive appliance for sure, so it may be financed when purchased new or rolled into a mortgage when buying an existing home or office, but it comes with a manufacturer’s warranty and will eventually be owned outright.

The service address becomes a dispatch location for maintenance services, just like the appliance provider down the road that services dishwashers and repairs ice makers. In fact your energy storage appliance will have a magnetic sticker on it that unabashedly promotes “Jake’s Energy Appliances” as the last provider to have serviced the appliance, which you call with your smartphone because you have no land-line. Since energy is generated and consumed locally, summertime brownouts and widespread outages caused by hurricanes become stories told to grandchildren as evidence of the much harder life endured by the story teller when they were a child. The grid morphs into thousands of microgrids, then into millions of nanogrids and then the meters disappear altogether, leaving just enough on-site energy generation and storage to meet each site’s demand.

Social Obligation

Energy ocean or archipelago: which eventuality we experience depends on the path taken, of course. The road to an energy ocean is evolutionary. A meaningful number of Investor Owned Utilities (IOU) and municipal utilities make the hard decisions early regarding existing business models. Via their net metering infrastructures they begin providing pricing signals that encourage rather than punish long-term connection to the electrical grid. Distributed generation is rewarded with favorable pricing while utilities carve out revenue from other services involved in maintaining the reliability of the grid and delivering centralized generation into underserved markets with favorable economics. These hard yet critical decisions keep utility companies and the electrical grid relevant long term.

The battle line is drawn at the meter. If utilities are not so proactive and continue to send pricing signals that encourage investment behind the meter, they will be locked out long term. Utilities have no control behind the meter beyond meter-based pricing signals so penalizing distributed generation and storage in order to preserve existing business models necessarily drives innovation behind the meter. Technology and financing creativity flourishes. Meeting residential and commercial energy needs onsite with economical generation and storage becomes commonplace and the grid becomes irrelevant because residential and business owners are forced to take control and hedge against the future risk of skyrocketing energy prices.

Social obligation plays into this story in at least two ways: the stranded utility customers who cannot invest behind their meter are left shouldering an unfair proportion of the utility’s profitability burden while the billions of large financial institution dollars tied up in utility bonds evaporate. Can market dynamics be allowed to dispassionately select the most efficient and economical solutions regardless of the social cost? Probably not.

There will be carnage, just like there was throughout the 30 years following the breakup of the Bell Operating Companies. Many and possibly even most of the utilities we know today will disappear. Large financial institutions will lose hundreds of millions and possibly even billions in capital tied up in stranded utility sector investments. Energy customers who cannot invest behind their meter will suffer much higher energy costs for a time. In the end the societal cost of a complete failure on either of these fronts is too high. Help will be provided. The grid will not disappear entirely. A steady state will be re-achieved that is mostly archipelago, but a fluid ocean like grid will persist in areas where there are fundamental limits to 100% onsite generation and storage. This grid will be funded and managed differently – no PUC but instead, public-private ventures will dominate the financing and ownership structures require for these large societal investments.

So the answer to ocean or archipelago is… yes.